Benefits for a better you – U.K.

Medical and dental? Life insurance? Perks? Whatever you’re looking for, Klaviyo has the benefits and resources to support your and your family’s ever-changing needs.

Who’s eligible for benefits?

You must be actively employed by Klaviyo for you and your dependants to be eligible for any benefits programmes.

Enrolling in your benefits

Klaviyos working in the UK can enrol in their Klaviyo benefits via the EMEA Benefits Enrolment Portal. Through this portal, you not only can enrol in benefits, but you can also access exclusive discounts.

Are you a new hire?

Your deadline to enrol in your Klaviyo benefits is the end of the month of the date you were hired.

After submitting your new hire elections, you can only make changes within the month you were hired; otherwise, you’ll have to wait until the next enrolment period, unless you have a qualifying life event.

To make changes to your new hire elections, email HR@klaviyo.com for help.

Qualifying life event

If you experience a qualifying life event, such as a marriage or divorce, the birth of a baby, or adoption of a child, you’re eligible to make changes to your benefits through the A2B platform by the end of the month in which the event occurred.

Your health

Better health? Own it. Live your life to the fullest with benefits and resources that support your overall wellbeing.

Medical

Klaviyo offers comprehensive private medical insurance through Vitality for all our UK employees and their eligible family members. You’re immediately eligible for coverage, and your previous medical history is disregarded.

How much you pay

The percentage that you and Klaviyo cover for you and any enrolled dependants is:

- Employees: Klaviyo pays 100% of the monthly premium.

- Spouse: Klaviyo pays 80% of the monthly premium; you pay 20%.

- Children: Both you and Klaviyo pay 50% of the monthly premium.

There’s an annual status linked excess of £150 that you must pay for services received before Vitality starts paying.

Excess Level Linked to Vitality Status

2025 Monthly Cost of Medical Coverage

What’s covered

- Inpatient, day-patient, and outpatient hospital fees and surgical procedures

- Advanced cancer support, including cover for various therapies, follow-up consultations and specified equipment to support treatment

- Therapies cover, including chiropractic, osteopathy, chiropody/podiatry, acupuncture, homoeopathy, and dietician services

- Mental health programmes and resources, including treatments such as psychiatry, counselling, and talking therapies

There’s a £0 excess for services received, so you don’t pay any upfront costs for treatment.

Rewards programme

Your private medical insurance also includes a rewards programme—receive 50% off a gym membership at Virgin Active, Nuffield Health, or PureGym gyms, one Caffe Nero coffee drink per week, 12 company-paid cinema tickets per year, merchandise discounts, and more.

Dental

Klaviyo’s private medical insurance through Bupa includes dental cover for you and your dependants, so you can manage the cost of dental care throughout the year. The policy subsidises the costs of treatment from a private dentist (up to annual limits) for different types of routine dental treatment. Cover includes:

- Preventive treatment (routine exams, scale, polish, X-rays)

- Restorative treatment (fillings, extractions, major restorative treatment)

- Full cover for NHS treatment

- Dental injury and emergency treatment

- Orthodontic treatment (where eligible)

Vision

EMEA employees can expense one eye test per year, and up to £50 per year towards glasses.

Modern Health

Modern Health is a wellness platform that makes it simple for you to access personalised care for life’s ups and downs—whether at work, home, or in your relationships. When you log in to Modern Health for the first time, you’ll answer a few questions about your wellbeing* and then be thoughtfully guided to resources that align with your specific needs and preferences.

Watch this brief video about Modern Health to learn how to access care.

How can Modern Health benefit you?

- Personalised support: Receive support in the areas that matter to you—whether that’s stress and anxiety, burnout, parenting, work performance, relationships, challenging life events, finances, and more.

- Mental resilience: Gain clarity on how to navigate challenges in your life, create healthy habits, build confidence, and improve your overall mental wellbeing.

- Community: Find group support sessions designed to be safe spaces to listen, share, and learn with others.

What’s included

- Eight one-to-one sessions per year with a certified mental health professional or a financial wellbeing coach

- Eight one-to-one sessions per year with a licensed clinical therapist in your country (with a guarantee of scheduling an appointment within two business days). This service is available to all full time employees, regardless of whether or not you are enrolled in a Klaviyo sponsored medical plan.

- Unlimited group support sessions (Circles)

- A library of guided meditations and self-paced digital courses

- Personalised and specialised work-life support for you and your whole family, including (but not limited to) people leader services, therapy for minors, ADHD coaching, couples counselling, eldercare, parenting, and caregiving

- Ongoing wellbeing assessments to track your wellbeing over time

Once registered, you can download the mobile app if you prefer to access services.

All employees should have the Modern Health app in their Okta dashboard, and all new hires will receive a welcome email before the end of their first week to register! Once registered, you can download the mobile app if you prefer to access that way as well!

* This data will be processed under each country’s relevant data protection regulation (such as HIPAA and GDPR, for example).

Your money

More money? Love it. Saving for your retirement provides you with financial security for your future.

Pension

Klaviyo’s group pension scheme helps you plan and save for your retirement on a tax-favoured basis.

You’re automatically enrolled in our group pension scheme, through Aviva, within your first month of employment.

Every year, Klaviyo will contribute an amount equal to 5% of your salary, provided you contribute at least 5% of your salary through salary sacrifice. With salary sacrifice, you agree to give up part of your contractual gross salary in return for non-cash benefits, such as pension contributions. The amount you give up is taken from your gross salary and paid straight into your pension as a contribution.

You do not pay any tax or National Insurance Contributions (NICs) on the amount you contribute, which helps you maximise your take-home pay.

You can opt out of the scheme at any time, but Klaviyo will automatically re-enrol you every three years.

Financial coaching

Take charge of your finances with Bippit financial coaching services. Bippit offers ongoing support and coaching from qualified financial professionals. Plus, you have access to a wealth of tools and resources to help you with saving and investing your money, decreasing debt, managing retirement tax, and more.

Get started today. Register at Bippit with your email address.

Life insurance

Klaviyo provides financial security for you and your family with life insurance through Unum. If you die, life insurance provides a lump-sum payment to your designated beneficiaries. Cover is equal to 4 times your annual base salary.

Income protection

All UK Klaviyos are covered under our income protection benefit through Unum. This cover provides financial support if you’re unable to work due to illness or injury.

After a 13-week waiting period, you’ll receive 50% of your salary for up to 5 years. You’re automatically covered up to £150,000 per year. If your salary exceeds £150,000 per year, you can request a higher benefit level by submitting an application or calling Unum underwriting at 0345 601 2177 to discuss your medical history.

For more information, visit Unum.

Lifestyle spending account

Klaviyo is dedicated to providing flexibility in your benefits so they work harder for you. Whether your financial freedom means wellness, fitness, or personal growth, we’ve got you covered. With a lifestyle spending account (LSA), it’s not just about saving, it’s about investing in you. Choose to use the LSA to help pay for gym memberships, mindfulness apps, personal development courses, or whatever else helps enhance your life. It’s a personalized approach to spending, because your well-being should be as much of a priority as your paycheck.

All eligible full-time Klaviyos will receive a stipend amount of £200 at the beginning of each quarter with an annual maximum amount of £800. Part-time eligible employees will receive a pro-rated amount based on their scheduled work hours. Note: you have to be employed on the first day of the quarter (January 1, April 1, July 1 and October 1) to be eligible for this benefit.

Your perks

More perks? Yes, please. Your health and your money are important to living your best life, but so are these added Klaviyo benefits.

Discover your perks

From paid holidays to reimbursements, we’ve got the perks to meet your needs and fit your lifestyle.

Annual leave

Klaviyo encourages you to take time for yourself, which is why all employees (new hires, rehires, and part-time) receive up to 28 annual leave days every year (prorated for part time and new starters after January 1) to rest and recharge.

2025 holidays

The London office will be closed on the following 2025 holidays. UK employees will have the day off.

Family leave

Being inclusive is a key value at Klaviyo, and we want to make certain that this is reflected in all our HR policies, processes, and programmes. With this in mind, we have enhanced our family leave policy in the UK to ensure that it’s applicable to all family types and that new parents feel supported.

Primary and secondary carer enhancements

Our enhanced family leave policy now offers primary carer and secondary carer entitlements. This recognises all family types and structures, regardless of gender.

- Primary carers are now eligible for 22 weeks of paid leave (in addition to statutory leave entitlements)

- Secondary carers are now eligible for 16 weeks of paid leave

New parents

Welcoming a new child into your family is exciting, and it’s important that you feel supported by Klaviyo during this time. Our new family-friendly policy supports all employees who are raising their children—no matter what the family make-up is, or whether individuals are welcoming a baby by birth, adoption, or surrogacy. To find out more, read the full policy on our Resources page.

This change is a significant step towards our vision of becoming a fully supportive, open, and inclusive employer, and we look forward to doing more over the next year.

Questions?

Reach out to HR@klaviyo.com to set up some time to talk through the logistics of your leave and get answers to any questions you have.

Sabbatical

So thank you for everything you do. Now get out there and take time for you!

Eligibility

Full-time Klaviyos who have been here for 5 years are eligible for 4 weeks of paid time off.

Get the details

Check out the sabbatical policy document and FAQs. Or go to the Klaviyo Wiki page (internal access only) for more information.

Learning for your lifestyle

Always learning? Get reimbursed. Klaviyos are always learning—and always trying to become better teammates, managers, subject-matter experts, and all-around humans. We want to reward you for that!

Learning for your lifestyle

Klaviyo reimburses you up to £2,000 annually for learning and training expenses: building skills that will make you successful in your current role or in future roles at Klaviyo. This benefit perk will be reimbursed through Forma.

Klaviyo Platform Reimbursement Program

At Klaviyo, our mission is to empower creators to own their own destiny. This applies to our customers along with our internal creators, Klaviyos themselves, who would like to use the Klaviyo software for their business entities. Due to a desire to utilize the Klaviyo platform, Klaviyo, Inc. created one unique Klaviyo Platform Reimbursement Program. This stipend is meant to provide you with funds to use towards the Klaviyo platform and growing your business.

Commuter benefits

Commuter benefits through Forma help Klaviyos pay for the expenses associated with going back and forth to work on the Tube. You can expense your commuter pass for the train within Forma. Klaviyo contributes £350 each month if you enroll.

Cycle to Work benefit

Through Cyclescheme, you can purchase a bicycle and accessories, up to £2500, and make payments through salary sacrifice over a 12-month period. You get the convenience of monthly payments, plus you save Income Tax and National Insurance on the cost of the voucher.

To learn more or get started, go to EMEA Benefits Enrolment Portal. You can also visit Cyclescheme for details.

Need help?

If you have any queries regarding your benefits, need help completing your election, or have any issues with the portal, contact Gallagher at uk_benefitshelpdesk@ajg.com and cc HR@klaviyo.com.

How to submit a claim

If you pay out of pocket for an eligible expense, you may choose to submit a reimbursement claim through the Forma portal.

Important notes:

- Please make sure that your item name, purchase date, and purchase amount are visible on the receipt. If this information is not visible, your claim will be rejected. If available, please also have your name on the receipt.

- For purchases made in apps such as Venmo and PayPal or online courses with recurring charges, please submit a screenshot or print screen of the charge and payment.

Don’t forget!

You can use the Forma app to easily upload receipts and submit claims.

Accessing Forma

You can access Forma with the Okta tile on your dashboard. If you are missing the tile, please email IT@klaviyo.com. If you’re enrolling for the first time, please use your Klaviyo email address.

Receiving and spending funds

With your allowance, you can shop in Forma’s online store where you’ll enjoy up to 30% off from Forma vendor partners! You do not need to submit a request for reimbursement when you purchase products through the Forma store. These items are already approved under your programme policy.

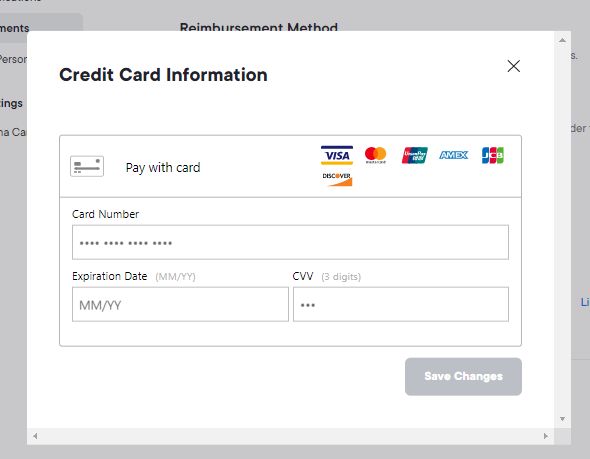

We recommend adding your personal credit card information to Forma’s portal. If an item from the store exceeds your available Klaviyo-funded balance, it will be denied. You can pay the difference using your personal credit or debit card and still enjoy the discount.

How to add your personal card

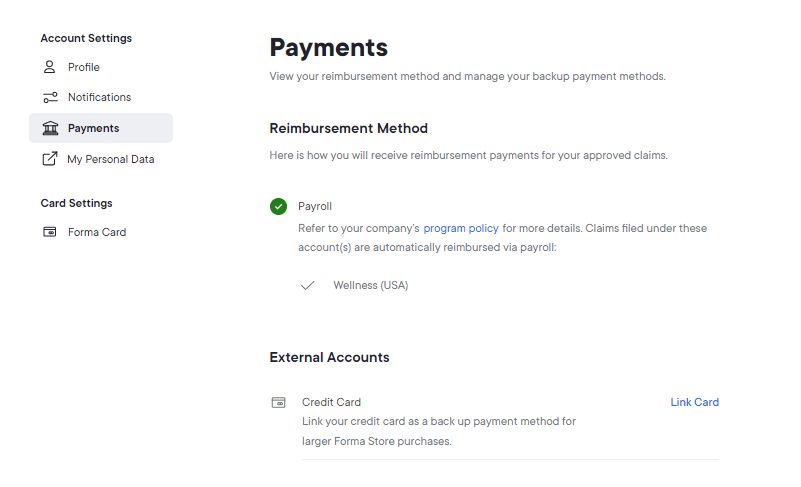

Log on to Forma’s portal through Okta. Under Account Settings, select Payments and navigate to Link Card. Enter your personal credit card information to supplement purchases that cost more than the amount you have in your account.

Note: If you do not add a personal card to your Forma account, purchases larger than your stipend amount will be rejected.

When can I expect my reimbursement?

Where should I go with questions?

For general questions, please refer to the help center. You can also reach Forma’s Member Experience team by emailing support@joinforma.com or through the live chat feature directly in your Forma account.

Contacts

Klaviyo Benefits Team

Pension

Aviva

0800 158 3142